modified business tax rate nevada

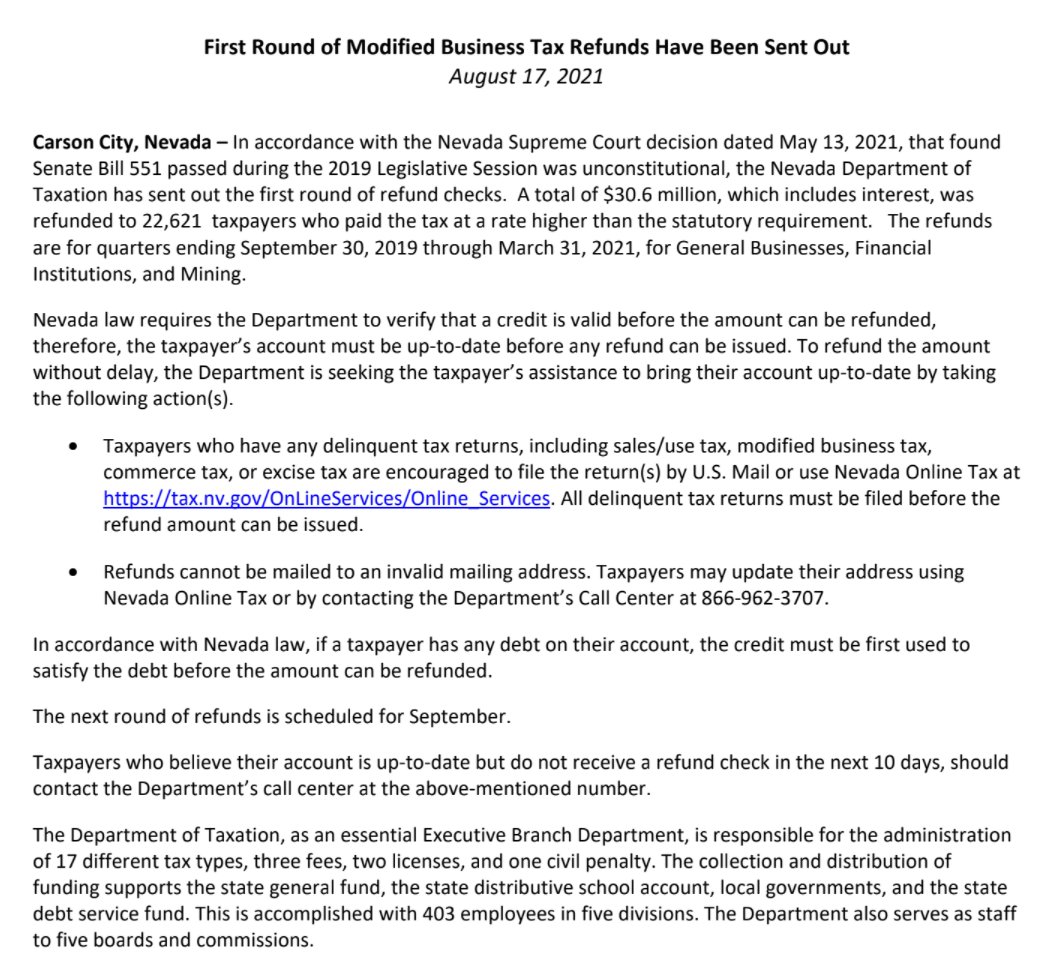

702 486-3377 MODIFIED BUSINESS TAX REFUND NOTICE Dear Taxpayer During the 2019 Legislative Session Senate. An industry that doesnt fit into any sector ie.

James Settelmeyer Settelmeyernv Twitter

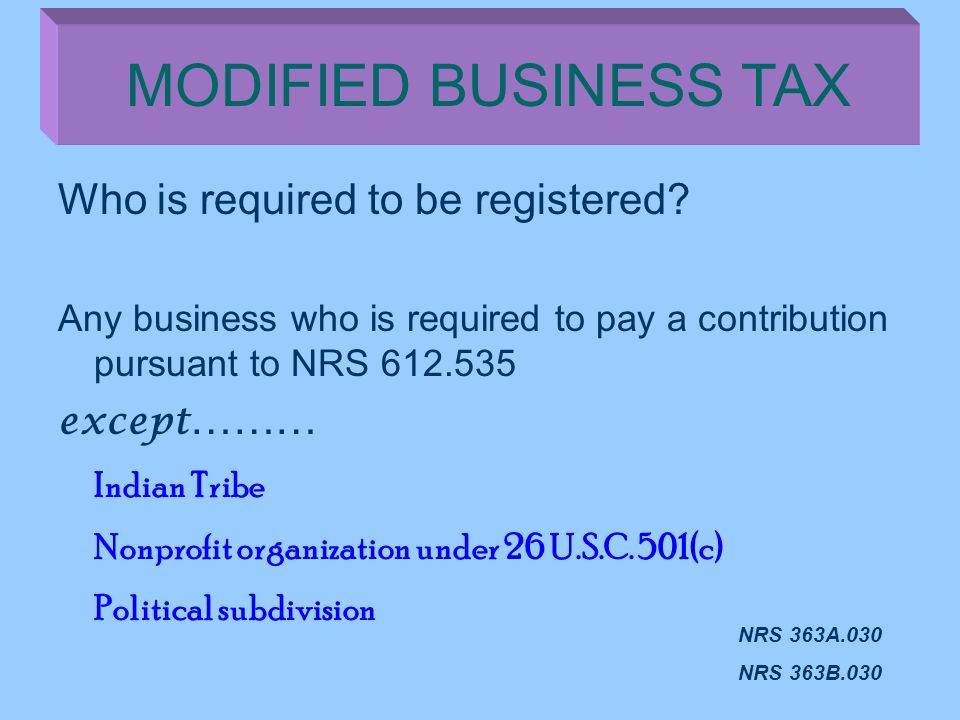

There is one general rate 1475 percent and a higher rate for financial institutions 20 percent.

. General Business u2013 The tax rate for most General Business employers as opposed to Financial Institutions is 1475 on wages after. 2 2 2 2 2 2 Ask The Advisors Basic Tax Academy State Of Nevada Department Of Taxation Ppt Download. However the first 50 000 of gross wages is not taxable.

Nevada Modified Business Tax Rate. Modified Business Tax has two classifications. Modified Business Tax has two classifications.

The previous tax was set at 117 above an exemption level of 85000 per quarter although certain industries such. There are no changes to the threshold of the sum of all taxable wages after deductions currently at 50000 or the Commerce Tax credit. The new Modified Business Tax rates for FY20 as calculated pursuant to NRS 360203 are 1378for general business and 1853 for mining and financial institutions.

Nevada has no corporate income tax at the state level making it an attractive tax. The Nevada Supreme Court recently held that a Nevada law repealing a previously legislated reduction of the Modified Business Tax MBT rate was unconstitutionally enacted. However the MBT is assessed for a given calendar quarter only if taxable wages for that quarter exceed.

8 20th SS at 20 of quarterly taxable wages and has not been changed since its October 1 2003. Henderson Nevada 89074 Phone. According to the court a bill that was passed during.

NRS 363B110Credit 50 of the amount of Commerce. However the first 50000 of gross wages is not taxable. As a result of the 2015 Legislative session the General Modified Business tax rate was increased to 1475 of net payroll General Modified Business Tax for wages under 50000 per quarter.

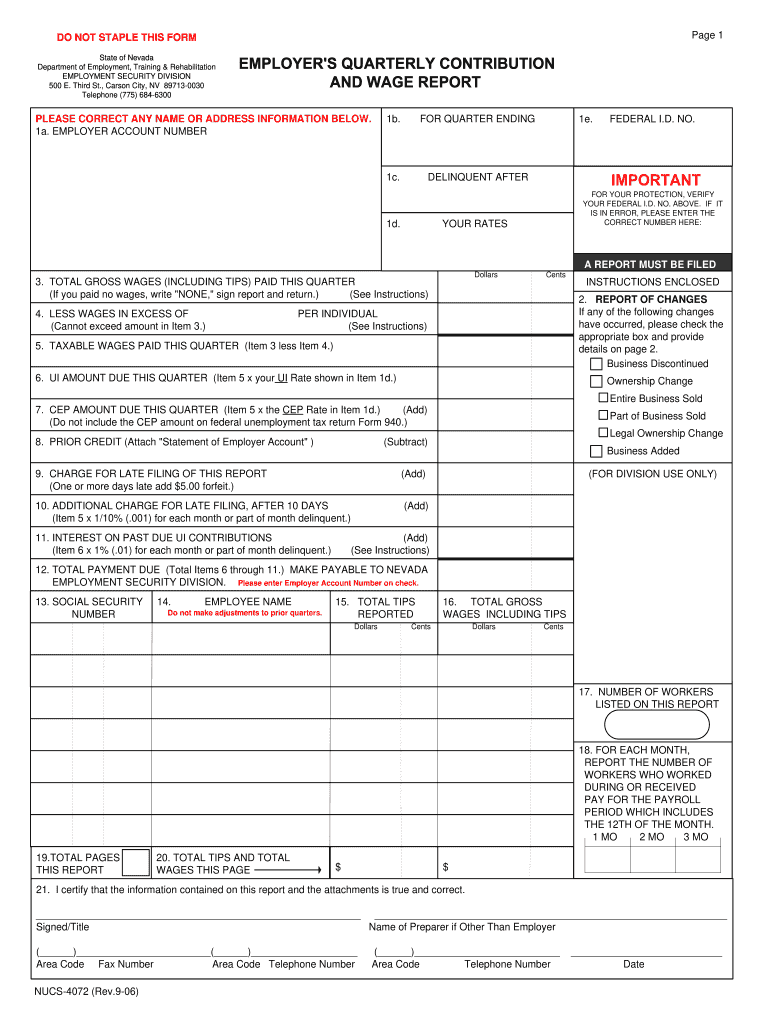

The Department of Taxation confirmed it is developing a plan to reduce the Modified Business Tax rate for quarters ending Sept. The tax rate for financial businesses under the MBT-FI was initially established in SB. The modified business tax MBT is considered a payroll tax based on the amount of wages paid out in a quarter.

101 000 - 50 000 51 000 x MBT Rate. Up to 25 cash back As of July 2015 the MBT rate is 1475. General Business The tax rate for most General Business employers as opposed to Financial Institutions is 1378 on wages after deduction of health benefits paid by the employer and certain wages paid to qualified veterans.

In 2015 legislation was enacted to reduce both MBT rates if general tax revenues exceeded a. The Nevada Supreme Court determined the Modified Business Tax MBT rate should have been reduced on July 1 2019. On May 13 2021 the Nevada Supreme Court upheld a decision that the biennial Modified Business Tax rate adjustment was unconstitutional and ordered the Nevada.

Effective July 1 2019 the tax rate changes to 1378 from 1475. The modified business tax is described by the Nevada Department of Taxation as a quarterly payroll tax. For example if the sum of all wages for the 9 15 quarter is 101 000 after health care and qualified veteran wage deductions the tax is 752.

31 2019 through March 31 2021 for. On May 13 2021 the Nevada Supreme Court ruled that two revenue-raising measures enacted by the state in 2019 were unconstitutional because they. Each sector is given its own gross receipt tax that would range from 05 percent to 33 percent.

Payroll Tax Nevada levies a Modified Business Tax MBT on payroll wages. Modified business tax rate nevada Saturday February 12 2022 Edit. A business that cant be classified will be taxed at.

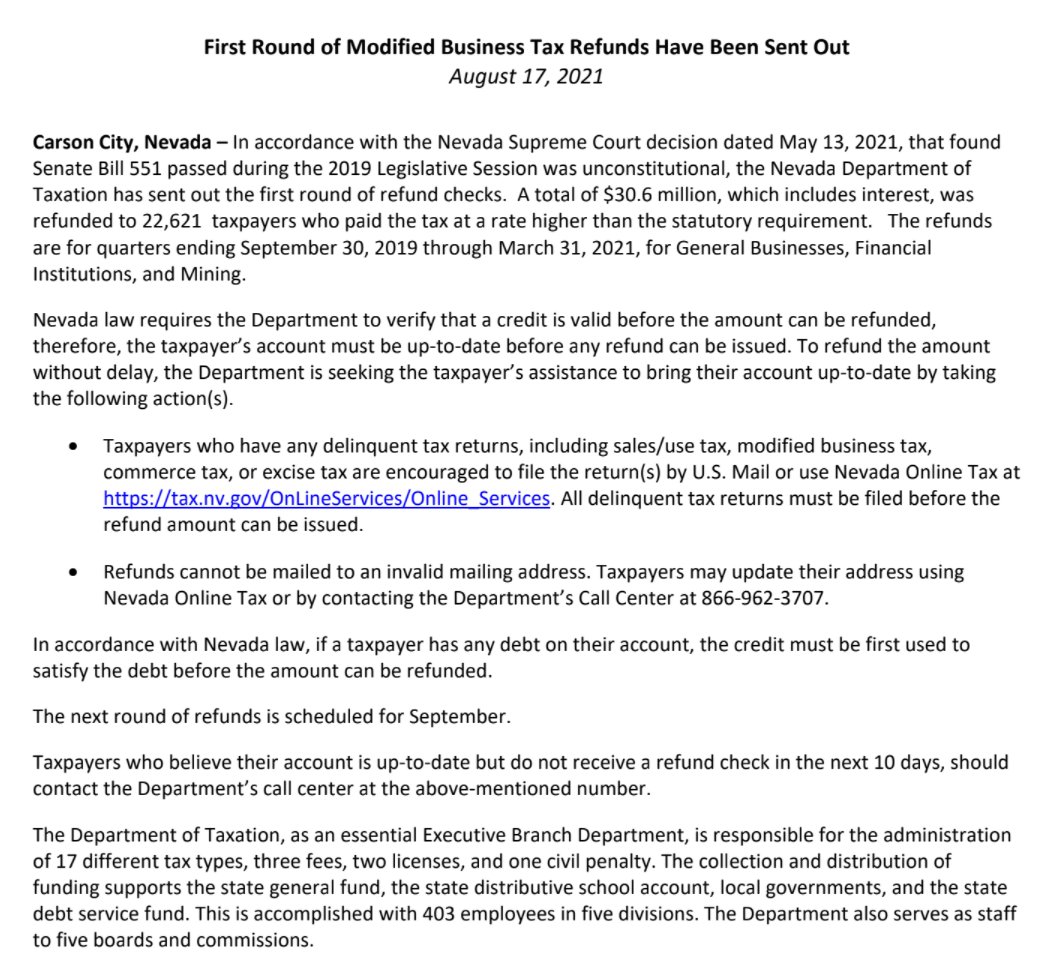

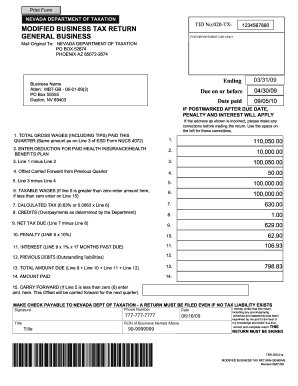

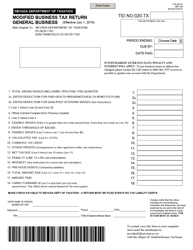

This is the standard quarterly return for reporting the Modified Business Tax for General Businesses. The MBT rate is 117 percent. Tax Bracket gross taxable income Tax Rate 0.

Imposition - A excise tax at the rate of 1475 of the wages paid by the employer during a calendar quarter that exceed 50000. 10 -Nevada Corporate Income Tax Brackets. T 1 215 814 1743.

It is assessed if taxable wages exceed.

Nv Dot Nucs 4072 2006 2022 Fill Out Tax Template Online Us Legal Forms

State Of Nevada Department Of Taxation Ppt Video Online Download

The Nevada Income Tax Rate Is 0 This Does Not Mean You Will Not Be Taxed On Your Earnings

2022 State Income Tax Rankings Tax Foundation

State Of Nevada Department Of Taxation Ppt Video Online Download

Does Qb Offer The Nv Modified Business Tax Payroll Form

2014 2022 Form Mt Ui 5 Fill Online Printable Fillable Blank Pdffiller

Nevada Consumer Use Tax Fill Out And Sign Printable Pdf Template Signnow

What Is The Business Tax Rate In Nevada

State Of Nevada Department Of Taxation Ppt Video Online Download

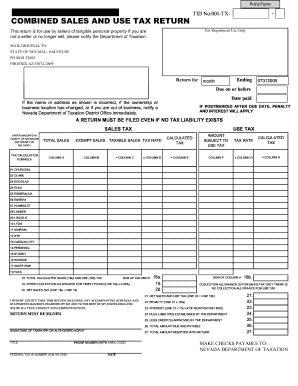

Nevada Department Of Taxation Forms Pdf Templates Download Fill And Print For Free Templateroller